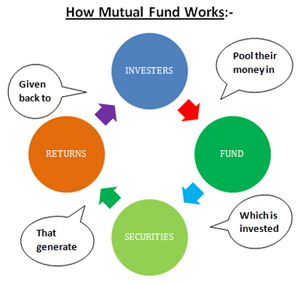

MUTUAL FUNDS

Mutual fund industry in India started in the year 1964, but it got its wings of growth post 1993 with advent of new private players. The industry has come a long way since then and manages assets of more than 8.82 lac crores. Mutual Funds are fast emerging as an important form of investments in India. The competition is getting intense by the day. The management of mutual funds is becoming more professional.

On the other hand the disposable surplus of the individuals across the nation is also on the rise. In these circumstances the financial planners are required to educate their clients on the finger points of investing in mutual funds. Today we have various variants of mutual fund schemes and it is becoming very difficult to the individual client to understand and appreciate the performance of these funds.

As an investor you have various options to invest your hard earned money. The ultimate aim for any investment is to create reasonable wealth with peace of mind.

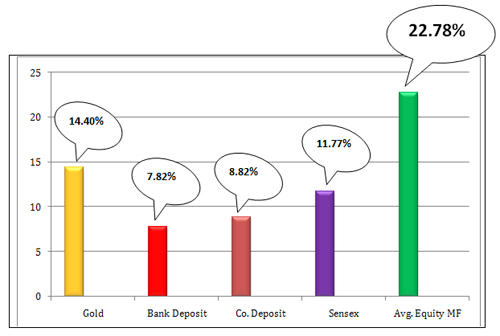

Equity Mutual Funds have also been available to investors as an investment options, but investors have mixed feelings with respect to returns, and the wide ranging perception for equity MF is negative. We have tried to work on the actual data of Equity MF schemes, which were present 15 years back and have gone through 1 cycle of bull and bear market, and to understand if they have been able to do justice to the investor.

GROWTH OF DIFFERENT ASSET CLASSES:-

Sources:

Gold: Reliance Money Precious Metals, MCX

Bank Deposit: Handbook of Statistics on Indian Economy, RBI

Co. Deposit: Assumed (1% higher than Bank FD Rate)

Sensex: www.bseindia.com

Equity Mutual Fund: www.mutualfundindia.com